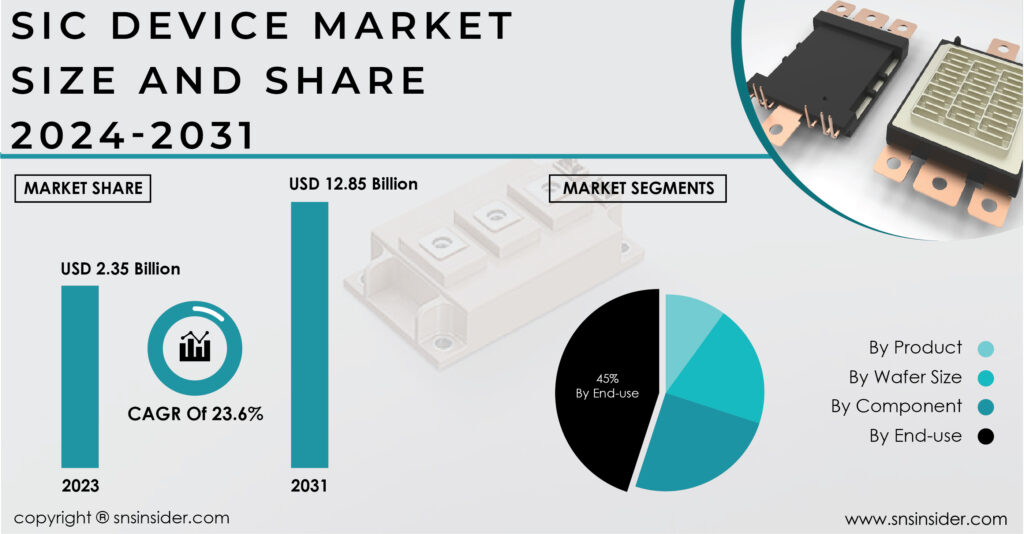

The SiC Device Market size was USD 2.35 Billion in 2023 and is projected to increase USD 12.85 Billion by 2031, with the CAGR of 23.6% during the forecast period 2024-2031, A report by SNS Insider.

Growing Demand for SiC Devices Across Diverse Applications

This market expansion can be attributed to the unique properties of silicon carbide (SiC) semiconductors. Compared to traditional silicon counterparts, SiC offers superior characteristics such as wider bandgap, higher thermal conductivity, and lower switching losses.

The Growing in demand for SiC devices is driven by the constantly Increasing electric vehicle (EV) industry. SiC having a ability to handle high voltages and currents efficiently makes it perfect for EV battery chargers, on-board chargers, DC-DC converters, and powertrains. This translates to faster charging times, increased driving range, and improved overall efficiency for EVs. Beyond EVs, SiC is finding applications in diverse sectors such as renewable energy (photovoltaic inverters, wind turbines), medical imaging (MRI and X-ray power supplies), industrial automation (air conditioning, auxiliary power supplies), and integrated vehicle systems. This widespread adoption across various end-user industries is Drive the SiC device market forward.

Download Free Sample Report of SiC Device Market @ https://www.snsinsider.com/sample-request/2971

Top Companies Featured in SiC Device Market Report:

- Coherent Corp.

- Fuji Electric Co. Ltd

- Infineon Technologies AG

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- ON Semiconductor Corp

- Renesas Electronics Corporation

- ROHM Co. Ltd

- Toshiba Electronic Devices & Storage Corporation

- WOLFSPEED INC

Recent Developments

In September 2022, ON Semiconductor Corporation (on semi) significantly expanded its silicon carbide fabrication facility in the Czech Republic. This expansion is anticipated to boost wafer production by 16 times within the next two years, catering to the rising demand for microchips.

The acquisition of GeneSiC Semiconductor by Navitas, a US-based semiconductor company, in August 2022, signifies the consolidation and advancement of next-generation power semiconductor technologies.

SiC Device Industry Segmentation as Follows:

By Product

- Optoelectronic Devices

- Power Semiconductors

- Frequency Devices

by product, in 2023, the Power semiconductors segment dominates the market, capturing a substantial revenue share of over 72%. This dominance is attributed to the inherent advantages of SiC, particularly its wide bandgap, which makes it highly suitable for power electronics applications. The wide bandgap translates to reduced equipment size, improved reliability at higher voltages and switching frequencies, and ultimately, enhanced system efficiency. the optoelectronic devices segment is poised for significant growth during the forecast period. This growth is Driven by the increasing adoption of SiC in high-energy laser and lighting applications. SiC’s exceptional thermal stability makes it a compelling choice for optoelectronic devices such as Light-Emitting Diodes (LEDs), solar cells, photodetectors, and telescopes.

By End-use

-

- Automotive

- Consumer Electronics

- Aerospace & Defense

- Medical Devices

- Data & Communication Devices

- Energy & Power

- Others

by End-user, the Automotive segment dominates the market with accounting a revenue share exceeding 49% in 2023. The segment is further categorized into electric vehicles and internal combustion (IC) automobiles. The widespread adoption of SiC semiconductors in both electric and IC vehicles is driving segment growth. The SiC offers superior durability for high-frequency switches and minimizes energy losses, making it ideal for converters, chargers, and inverters in these vehicles. These advantages translate to improved energy efficiency, reduced weight of electronic components, and ultimately, a significant boost in overall power density and efficiency. This bodes well for the sustained growth of the automotive segment within the SiC device market.

By Component

- Schottky Diodes

- FET/MOSFET Transistors

- Integrated Circuits

- Rectifiers/Diodes

- Power Modules

- Others

By Wafer Size

- 1 inch to 4 inches

- 6 inches

- 8 inches

- 10 inches & above

Ask Your Query Before Buying this Research Report @ https://www.snsinsider.com/enquiry/2971

Impact of Global Events

The report acknowledges the potential impact of global events such as the Russia-Ukraine war and the economic slowdown. The war has disrupted supply chains and caused volatility in raw material prices, potentially impacting the production and cost of SiC devices. an economic slowdown could lead to reduced consumer spending and Reduce investments in industries that rely heavily on SiC technology, such as electric vehicles and renewable energy.

Regional Analysis

The Asia Pacific region is Dominates the SiC semiconductor devices market, holding a dominant revenue share of more than 44.23%. This dominance can be attributed to The region boasts a well-established presence of leading SiC device manufacturers. These players act as a growth engine for the market, driving innovation and production capabilities. Governments and private companies across Asia Pacific are increasingly investing in SiC development and manufacturing facilities. This upsurge in investments fosters regional production capacity and strengthens the market position. End-user industries in Asia Pacific are exhibiting a growing demand for SiC devices due to their superior efficiency, smaller size, and lighter weight. This demand fuels market growth as manufacturers cater to these evolving needs.

North America region is anticipated to significant growth during the forecast period. This can be Driven by due to the presence of established industry players such as GeneSiC Semiconductor and ON Semiconductor Corporation (on semi). These companies possess extensive customer bases within the region, driving market expansion through their well-developed sales and distribution networks.

Key Takeaways for the SiC Device Market Study

- The report identifies the key factors propelling market growth, such as the rising demand for sustainability and electrification. It also explores potential opportunities in various end-user industries such as electric vehicles, renewable energy, and industrial automation.

- The report sheds light on the competitive landscape by identifying leading players in the SiC device market. Additionally, it analyses regional trends, highlighting the dominance of Asia Pacific and the anticipated growth potential in North America.

- By understanding the market dynamics, growth factors, and regional trends presented in the report, stakeholders can make informed decisions. This includes product development strategies, investment plans, and market expansion tactics to capitalize on the burgeoning SiC device market.

Table of Content – Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

4. Impact Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. SiC Device Market Segmentation, By Product

9. SiC Device Market Segmentation, By Component

10. SiC Device Market Segmentation, By Wafer Size

11. SiC Device Market Segmentation, By End-Use

12. Regional Analysis

13. Company Profile

14. Competitive Landscape

15. USE Cases and Best Practices

16. Conclusion

Continued….

Access Detailed Research Insight with Full TOC and Graphs @ https://www.snsinsider.com/reports/sic-device-market-2971

About Us:

SNS Insider has been a leader in data and analytics globally with its authentic consumer and market insights. The trust of our clients and business partners has always been at the center of who we are as a company. We are a business that leads the industry in innovation, and to support the success of our clients, our highly skilled engineers, consultants, and data scientists have consistently pushed the limits of the industry with innovative methodology and measuring technologies.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US)